What is a Financial CRM?

What is a Financial CRM?

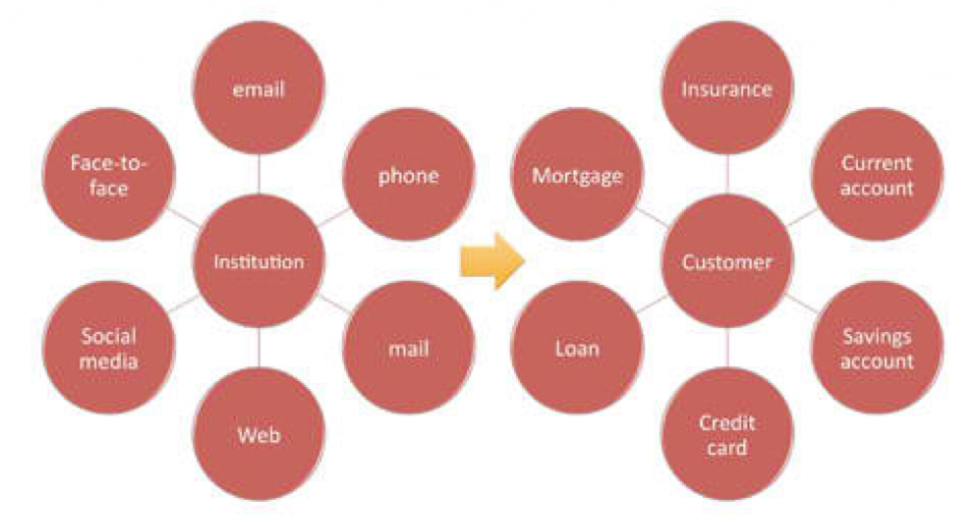

CRM or Customer Relationship Management is a software tool that is used to manage the customer database through improving existing relationship, prospecting for new customers, and winning back past customers through utilizing multiple features of the CRM system.

Similarly, a financial CRM is a kind of CRM that is used in the financial industry by companies, agents or advisors to collect, organize, manage and utilize customer information for business growth. The financial CRM has the addition of industry data with close integration to customer’s profile such as loans, credits, investments and insurance etc. that are analyzed and automated with workflows to manage client relationship and growth.

Types of Financial CRMs

There two types of financial CRMS available in the market. The industry specific CRMs are focused toward insurance, banking, investment and other related services. These kinds of CRMs provide unique functionality for their use but may not have advance features like business intelligence, analysis modules or integrations with other applications.

The second type is multipurpose advance CRMs that have intensely customized financial workflows, and API integrations. Such CRMs are flexible enough to fulfill diverse needs for different companies or usage. Although, they can be created in-house, but there are many commercial CRMs available in the market which provide partner development program to customize their CRM as per your need.

Related: How to become a Successful Financial Advisor.

Common Features

The financial CRM features may vary for different brands and depending on their pricing, flexibility and deployment structure. Regardless of the type, all CRMs have some common features that are considered to be essential. These functionalities are included in their basic level subscription plans.

- Customer Contact Databases

- Calendars and Scheduling

- Automated Alerts and Notifications

- Internal Collaboration Tools

- Analytics and Reporting

- Lead and Opportunity Management

- Sales Funnel Pipelines

- Customer Price Quoting

- Relationship modeling

- Workflow Customization

- Know Your Customer (KYC) verification

- Integrated Billing or Invoicing

- Financial Account Management

Characteristics of Financial CRM

Many people still think that it is unnecessary to use financial CRM and add additional cost to expenses. They say it is just managing the customer contacts and communication which can be done on worksheets and email, while other tasks can be performed manually or by using other tools.

More than Contact Management

Practically, financial CRMs are more than just customer contact management. The key is to select a suitable CRM as per your need and implement it properly so that it facilitates the business operations, save time and increase revenue. There are certain tactics that organizations can adopt to maximize return on investment.

Workflow Automation

Workflow automation is the biggest benefit of financial CRM. Users can create custom fields and logical workflows to streamline customer on-boarding, documentation, portfolio analysis, KYC related functions. Many advance CRMs have pre-designed workflows and customized functionality of the industry niche. Users can utilize them to save time and efforts to create their own workflows.

Centralization

Centralization is the most important advantage especially for the reporting authority as they can see the progress, current status and productivity bottlenecks for individual team members as well as the whole team. Users can also have a bird view to identify opportunities, utilize past experiences to progress faster. The centralized dashboard gives clear information about where is the organization standing right now and how can they improve.

Analysis and Reporting

The analysis and reporting tools help financial advisors strengthen their understandings and discover opportunities and identify risk factors in advance. These tools also help in presenting findings and results to clients as well as management.

Mobility and Flexibility

Modern Financial CRMs are fulfilling the need of remote working too. As many businesses have stated working remotely due to COVID-19, the agents are managing their clients from their home. According to IDC, it is expected that 1.5 billion people will be working remotely by the end of this year. And this speculation was before COVID pandemic.

Many CRMs have already integrated video conferencing tools to help advisors meet their clients virtually. This is also important for frequent travelers to manage their business efficiently. CRMs have become fully accessible on mobile phones, tablets and other devices as well so that the productivity doesn’t stops.

As discussed above, there are numerous benefits of using a financial CRM, no matter the size of the organization. Even some modern CRMs like BlueMind are specifically customized for individual advisors to make them affordable with complete ownership of the data.

The financial CRM not only helps business grow but also develops advisors by providing the tools and tactics for their professional growth. With Financial CRMs, advisors can focus on important activities to improve their client relationship without wasting time and efforts on manual tasking or using multiple software.