Top Productivity Hacks for Financial Advisors

The main goal of a financial advisor is to provide sound advice to their clients, implement, and monitor their progress throughout their lives. With so many new and complex products and regulations entering the market it is challenging to keep up to date on all the information and administrative requirements. Add to that the fact that as a financial advisor, your income is closely tied to how productive you are, it places a lot of stress on managing your day. Therefore, here we present top productivity hacks for financial advisors.

Top Productivity Hacks for Financial Advisors

There are thousands of advisors in the marketplace and each of them will have their own technique for managing their work operations. To adopt all of their lists for a successful practice is not feasible either.

The common denominator for building the most successful financial advisor career is to be disciplined, focused, work hard, and specialise in what your ideal clients or niche market wants. In addition to that most successful advisors have proper processes and mentors to guide them. There is no miracle cure!

Before going into details, you can watch a short video to find out what those four productivity hacks are.

https://www.youtube.com/watch?v=iHKRpSLRb5Y

1. Build Trustful Relationships with Clients

The key and most important fact is that you must form solid relationships and build trust with your clients, and build the technical knowledge around giving advice. The more time you can spend in front of prospects and clients, crafting the right solution for their goals and needs, the bigger of an impact you can have on their lives and your life.

Related: Tips for Working Remotely as an Advisor

2. Maintain Healthy Lifestyle

Let’s take everyday life as an example. In order for us to function optimally we need to be in good health. We must eat well, exercise, and get a good amount of sleep in order to perform. If we don’t then we are constantly fighting against the tide. Once we take control of our physical and emotional well-being we can handle other stresses more effectively.

3. Improve Soft Skills

Spend time to focus on soft skills. Your brand is not just your logo and photograph, it is who you are and how you engage with and treat people. How you dress, speak, and LISTEN will attract people to you. When we think of great customer service, don’t we all want to be treated with respect and feel valued? Well this is what customers want. You can have all the technology and marketing plans at your fingertips, but if you cannot attract and retain your customers it means nothing.

4. Utilize CRM to Avoid Repetitive and Manual Tasks

The most beneficial device that will add time to your busy day while you juggle work and family, is a proper CRM tool. Labelled as a Client Relationship Management tool, it does just that, helps you manage your relationships. To reduce administrative tasks is paramount to able to spend more quality time with your customers to foster relationships.

There are hundreds of tools in the market today, each one touting that theirs is the best. They are designed to bring organization, order and quality to help you stay on track and engaged. The more you grow the more you will need and depend on the right type of software. The automated functionality as grown leaps and bounds including information emails, greetings for milestone events, reminders, tasks and to-do’s, plus very important compliance features. CRM has become the new “personal assistant.”

Compliance and privacy have become stricter to adhere to fiduciary responsibilities. Along with the governance comes more administrative duties. This is where the right CRM becomes essential.

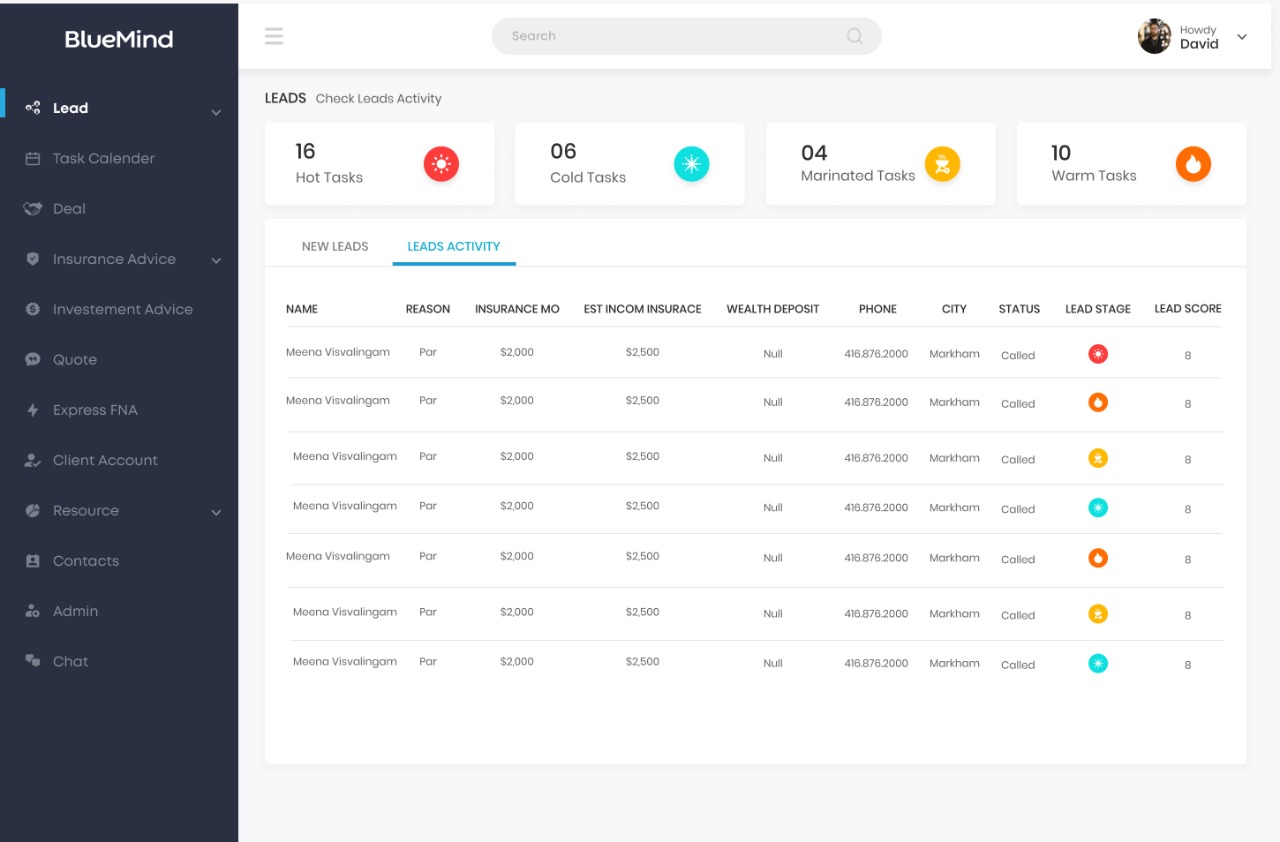

We see the struggles of financial advisors as they make considerable efforts to grow their business. To alleviate the burden of administrative strains we have introduced “BlueMind”.

BlueMind uses the power of artificial intelligence to create order and quality for advisors without missing a beat. It takes care of the compliance aspects of financial advice while still providing other automated functionality that is important to keep your finger on the pulse.

To tie everything up in a nutshell, financial advisors must take the time to review their personal and business lives. They need to organize themselves in a way that works for them to manage a successful practice.

Happy advising!