Survival Strategies for New Advisors

If you are a young financial advisor who is new to the business, you probably have the drive to succeed. But you should recognize that success takes time, patience and hard work.

Typically, young advisors want flexibility to do things their way, especially if they're millennials who strive to prove themselves and want to be recognized for their contribution.

But newcomers to the business must have the right behavior and attitude and be willing learn if they are to fit in and grow in their roles. In addition, they must recognize that they don't operate in a vacuum and must be respectful of rules in a regulated environment.

Although new advisors are expected to bring fresh perspective, they must remain cooperative and flexible and should use their skills to add value to the practice.

Here are survival strategies for new advisors:

1. Seek Guidance and Training

You must be realistic about your strengths and weaknesses. Do some self-examination and self-reflection on what you like most about being a financial advisor.

Recognize that you have a lot to learn, and don't be afraid to ask your mentor or a more experienced colleagues for guidance.

Invest in yourself by attending industry courses and seize every opportunity to participate in internal training sessions.

2. Listen and Learn

Keep your eyes and ears open and learn as much as you can from your peers. Become like a sheet of blotting paper. The more you learn, the stronger you will become.

Use every client meeting as a learning experience. Show your appreciation for feedback and don't be afraid to ask questions or seek clarification. For example, if a client disagrees with a recommendation, ask why.

3. Embrace different Opinions

Acknowledge that you will be exposed to differing perspectives and remain open to new ideas.

There are different means to the same end and the views of your colleagues might be different from yours. That doesn't mean that you should be afraid to express your opinions or put forward a fresh perspective.

Your colleagues could very well come around to accepting your opinion. At this stage of your career, your goal should be to earn the respect of your colleagues by demonstrating that you are a valuable member of the team.

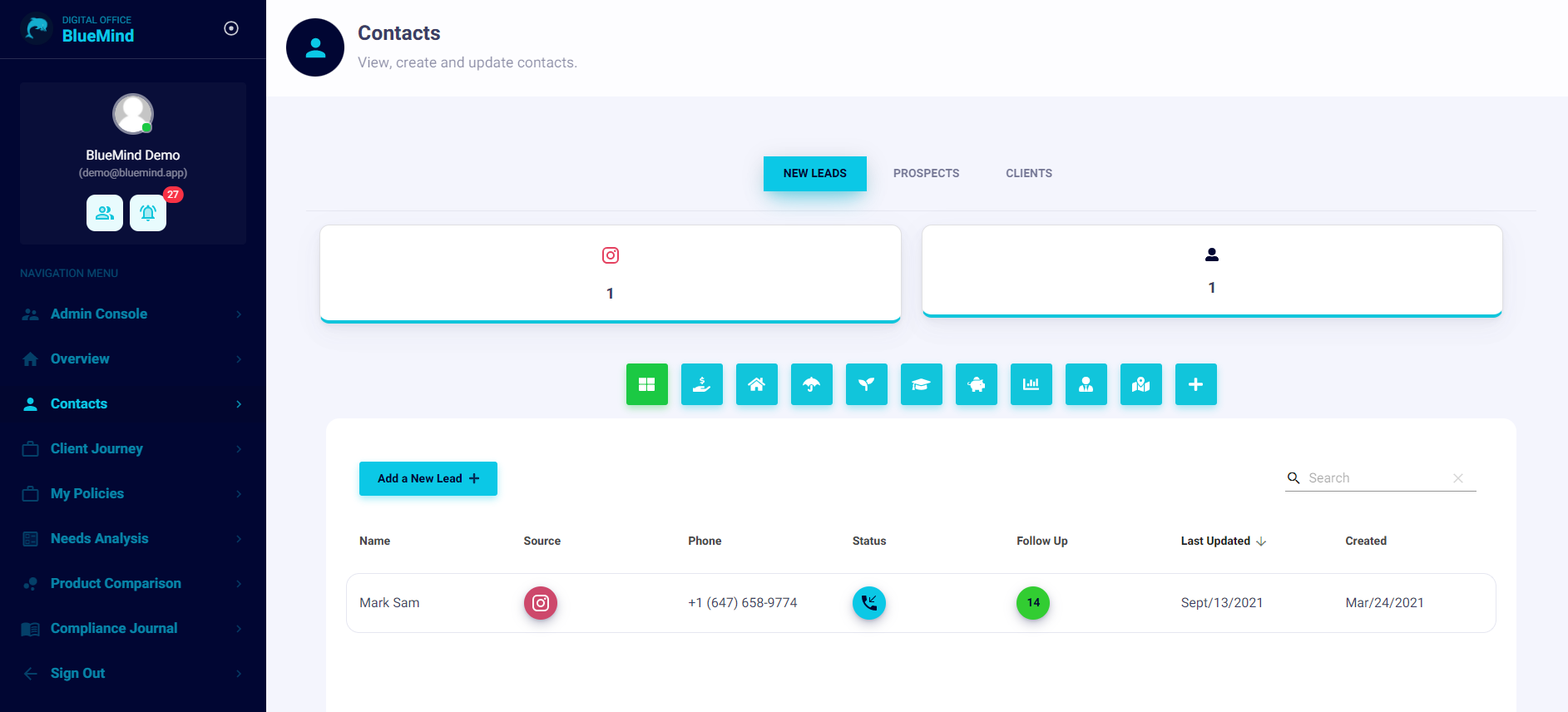

4. Maximize use of Technology

No practice can be successful without the appropriate technology. Typically, you will have to maintain client data, prepare financial plans, and client statements, monitor performance, complete needs analysis, communicate with clients and schedule meetings. Having an integrated digital office like BlueMind.app to support these activities is critical to maintaining an efficient practice.

5. Digitize Key Processes

Digitizing key processes you perform on an ongoing basis makes it easier for you and support staff to carry out their responsibilities in a compliant manner. It also gives you assurance that your staff knows what needs to be done on an ongoing basis. This will ensure that your practice is always compliant.

6. Develop a Marketing Message

Develop a consistent marketing message which incorporates your value proposition. All elements of your marketing must be tailored to your ideal-client type. Learn to "Speak their language." Once you engage potential clients in conversation, try to create a "mental imprint" by asking questions about challenges they face. The ultimate intent, he says, is to offer solutions to them.

7. Be Humble, Not Cocky

Show humility in dealing with your colleagues and your clients. Accept that you will face opposition in some of your interactions, and be sure to resolve any disagreements with courtesy and respect. Be humble, not cocky.

But although you are new, you should maintain your self-respect. Do not regard yourself as below your colleagues.

You might not have as much experience but that doesn't mean you don't play an important role.