How AI is Aiding the Financial Industry?

Have you ever wondered why the British currency was named Pound? The answer is simple. Britishers are among the first people to use paper currency instead of gold or silver coins.

The story goes that the first banks used to store gold, rather than actual money. Whenever a person made a deposit, he was given a paper note stating how many “pounds” have been deposited in the bank. Soon, people started trading these paper notes rather than actual gold in exchange for products or services. A couple of decades later, Gold was ditched entirely in favor of paper currency.

So this is how banks came into being. These financial institutions have evolved a lot over the years. And so have the payment methods that we currently use. Previously, we used to have checkbooks. Now, we use credit and debit cards.

Much of this innovation actually happened through the use of advanced technology. Banks have always stayed one step ahead and promoted the use of technology to add greater convenience for their customers. Today, we’re seeing a major change happening here thanks to advanced AI technologies that have been made available to the market today.

But how is AI actually aiding this Trillion Dollar industry? We’ve put together some points to answer this exact question.

Related: What is a Financial CRM?

AI for Credit Risk Assessment

Payment methods have experienced a lot of innovation over the years. Previously, people used cash or cheques while making payments. Today, most people use Debit and Credit cards to make all kinds of payments. A recent study reveals that 77% of consumers prefer using a Credit or Debit card to make payment for services.

With so many preferring Credit cards over other payment options, this puts a lot of pressure on banks that issue out these cards to the public. There are various methods banks use to decide if a person is eligible to be given a credit card or not. These methods usually revolved around the credit score of a person. However, it is now understood that this method might not be very efficient for the business. Which is why it is time to move on by using better technology.

Today, it is possible for banks to make better and more efficient decisions while assessing the risks involved in giving credit to a customer. Information such as the person’s loan repayment habits, the number of loans currently active, and the number of existing credit cards under that person’s use can come in handy in making an effective risk assessment. This is where AI can come into play.

It is not possible for mere human beings to go through thousands of personal financial records and come up with an effective decision. This is a job that is better dealt with by machines, more specifically Artificial Intelligence.

Today’s AI is advanced enough to find and read through loads of data and produce the right solution in mere minutes. AI can easily take the place of human analysts and actually come up with better and more efficient results than their human counterparts. Not only does this method spell well for the business, but the customer would also be a beneficiary in this thing as there is now a greater chance that the right people would be given a chance to get a credit account from the banks.

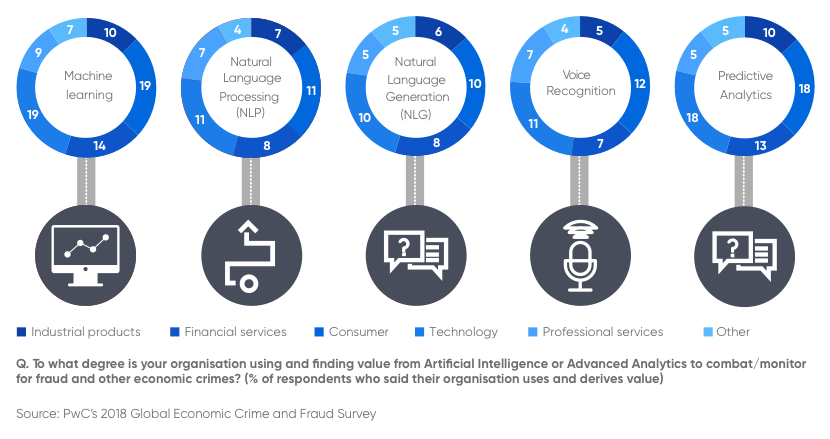

AI in Fraud Detection

There are high chances of fraud wherever money is involved. For instance, banks use other people’s money to run a profit and maintain a healthy cash inflow. This puts a lot of pressure on them. Not only do they have to pay the money back to their lenders with interest payments, but they also have to pay salaries and take part in other expenses that come with providing services to loads of people every day.

With such strict conditions in play, financial institutions cannot risk handing out large sums of money to fraudsters. It is important for banks to take fraud very seriously. This is why fraud identification is given a lot of importance in these institutions. This is where AI can come into play.

The best thing about Artificial Intelligence is that it can be taught to detect certain behaviors and make improved decisions by feeding it with the right data. Humans are likely to make mistakes. But the same isn’t likely with Artificial Intelligence.

By feeding it with the right data, AI can help detect fraudulent behavior before it can bring any harm to the institution. By putting up red flags at all the relevant places, AI can help alert the institution before it suffers the impact of fraud. The institution can then take necessary steps beforehand and avoid suffering any blows to their Income Statement.

The Future is AI

There is no doubting the fact that AI would be the future of not just the financial industry but for the world as a whole. AI can add greater efficiency to any business. It can bring improvements in areas we can only dream about.

Analysts at International Data Corp. predict that worldwide revenues for the rapidly growing AI market could top $500 billion by 2024. Bankrate's guide inform readers about the rise of AI in numerous industries, as well as ways to invest in this technology.

Although the technology is still in its younger stages, we believe that it would soon outgrow its current capacity and change the world as it is today.