BGAs with 500+ Advisors can avoid over $800K in Compliance Fines

While cutting their compliance costs by 87%

Without hiring more compliance officers and facing staff burnout

The Compliance Nightmare Keeping BGA Leaders Up at Night

The Cost Crisis

You're spending $300K+ annually on compliance staff and STILL can't monitor every advisor in real time.

Expensive

The Talent Crisis

You can't hire compliance officers fast enough to keep up with advisor growth. And good ones cost $150K+ each.

Unsustainable

The Risk Crisis

One rogue advisor can trigger a $500K+ fine that wipes out your entire year's profit—and you won't even see it coming.

Terrifying

Sound familiar? You're not alone.

But what if there was a way to 10X your compliance capacity without hiring a single additional person?

That's exactly what BlueMind does!

Case Study

ABC Company Case Study info here

Why BlueMind Works When Everything Else Fails

Here's Everything You Get With BlueMind

-

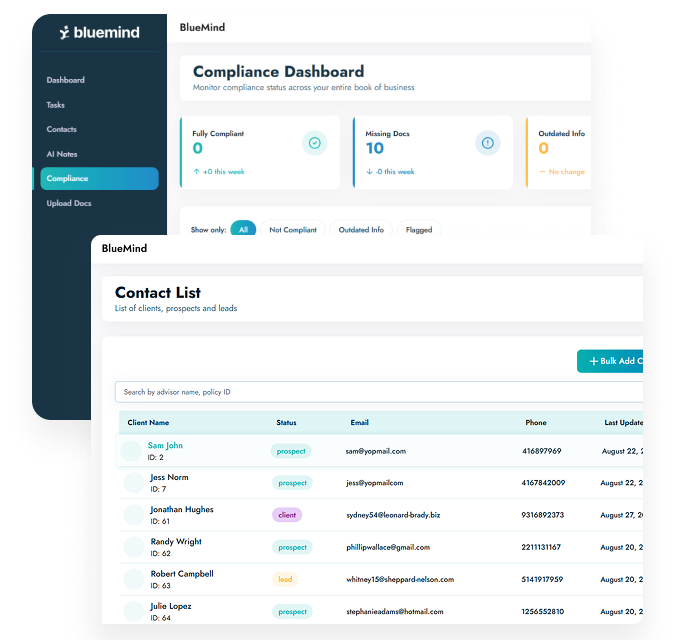

Real Time KYC Policy and Advisor Supervision Tracking

BlueMind works with direct data feed/API or from your existing back office tools.

-

AI-Powered Report functionality

Generate AI-powered reports to proactively take actions.

Evidence for regulators and insurance companies. -

Centralized Compliance Operations

Centralized document storage, note-taking, e-signature capture, client file audit trails, and policy linkage—eliminating siloed data. -

Leadership Heatmap & Analytics

Visualize advisor actions across your entire org: from meetings to transactions to compliance follow-ups.

-

Real-Time Alerts for Supervisors

AI-powered engine for real-time monitoring. Get notified when red flags emerge, when advisors miss deadlines, or when client files are incomplete.

-

Custom Supervision Workflows

Tailored review flows based on FSRA, CIRO, FINRA, and firm-specific rules—perfect for dual-licensed firms in Canada and the U.S.

-

API connecting to existing tools

Seamlessly connect to your existing tools and systems.

-

White-Glove Setup & Customization

We work with your leadership and compliance team to map out processes and set up your compliance workflows, reporting, and alerts.

TOTAL VALUE: $900K+ annually

YOUR INVESTMENT: Starting at $99/month per user

Our Sleep Better Tonight Guarantee

BlueMind will catch compliance risks you're currently missing that we'll make you this promise:

Implement BlueMind start using it within weeks.

-

White-Glove Onboarding, setup and customization

-

From the moment you join, we will take care until you feel confident to use the platform

-

Live Progress Updates to keep the onboarding on track.

-

Give you complete peace of mind about your regulatory exposure

What Makes Today Different

.jpeg)

-

The SEC and FINRA are ramping up AI-powered audits in 2026.

-

They're using machine learning to flag compliance patterns

across thousands of firms simultaneously. -

BGAs WITHOUT predictive compliance systems are 7.3X more likely to face regulatory action in the next 18 months.

Frequently Asked Questions

How does BlueMind support enterprise-level compliance, supervision, and auditing?

BlueMind’s enterprise system gives BGAs, IMOs, and enterprise insurance distributors a structured compliance supervision system that helps them monitor advisors in real time, reduce regulatory risk, and stay audit-ready at all times.

Centralized Supervision Dashboard

Firms get a consolidated view of advisor activities, including notes, onboarding steps, documentation uploads, client interactions, and policy submissions.

Supervisors can quickly see where advisors are compliant, where items are missing, and what needs attention.

Real-Time Compliance Monitoring

BlueMind continuously checks advisor activity against the firm’s required documentation and processes (e.g., KYC, KYP, disclosure, suitability, needs analysis, client notes).

Missing steps are flagged automatically so supervisory teams can intervene early.

Structured, Auditable Records

Every advisor action — including notes, documents, meeting summaries, approvals, and compliance reviews — is stored with timestamps and linked to the corresponding client file.

This ensures firms have complete, organized records ready for FSRA, CIRO, FINRA, or internal audits.

Configurable Compliance Rules & Workflows

Enterprise firms can define their own:

- Documentation requirements

- Review and approval workflows

- Risk categories

- Escalation paths

- Regional variations

This ensures BlueMind adapts to the firm’s supervision model and regulatory environment.

Advisor Activity Logs & Evidence Exports

Supervisors can generate advisor-specific or policy-specific activity reports showing exactly what actions were taken, when, and by whom.

Exports are formatted to support internal audits, regulatory reviews, and carrier oversight files.

Integration With Existing Systems

BlueMind’s Harmony can integrate with CRMs, policy admin platforms, contracting/onboarding systems, and carrier data feeds to give firms a complete supervisory view across the advisor lifecycle.

Can BlueMind be customized to align with our firm’s processes, branding, or data governance policies?

Yes. Enterprise plans include tailored configurations such as custom workflows, advisor approval paths, document-handling rules, data-segregation settings, and branded client-facing materials. Our team works directly with your leadership and compliance department to ensure BlueMind fits seamlessly into your firm’s operational and governance framework.

What onboarding and support services are available for enterprise deployments?

Enterprise clients receive white-glove onboarding, including data migration support, team training sessions, sandbox environments for internal testing, and a dedicated account manager. We also provide ongoing support, quarterly business reviews, and priority access to product updates to ensure long-term alignment with your firm’s goals.