DESIGNED BY ADVISORS FOR ADVISORS

The All-in-One CRM and Automated Compliance Platform for Insurance & Financial Advisors!

DESIGNED BY ADVISORS FOR ADVISORS

The All-in-One CRM and Automated Compliance Platform for Insurance & Financial Advisors!

What if Every Part of Your Work Day got Easier?

-

Centralize your practice

-

Streamline compliance

-

Automate routine tasks

-

Stand out from the crowd

-

Serve clients with less effort

-

Manage prospects better

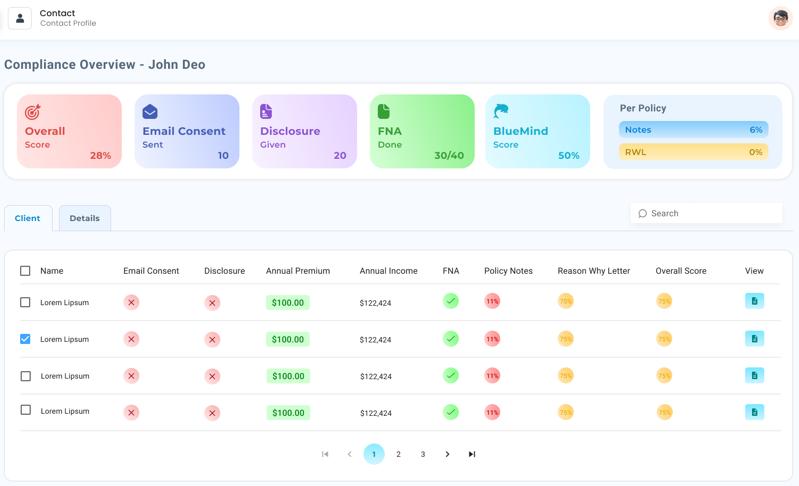

Every advisor worries about compliance. Authorities have become stricter. Risks are higher. Tangible proof is required. BlueMind provides ongoing audit-ready proof automatically. It’s like a checklist that won’t let you make a mistake.

All advisors have to step forward into the digital future. Most are still lagging. BlueMind is your smooth way forward. You can't get lost because it’s designed to take care of you. It’s an easy way to gain a powerful competitive advantage.

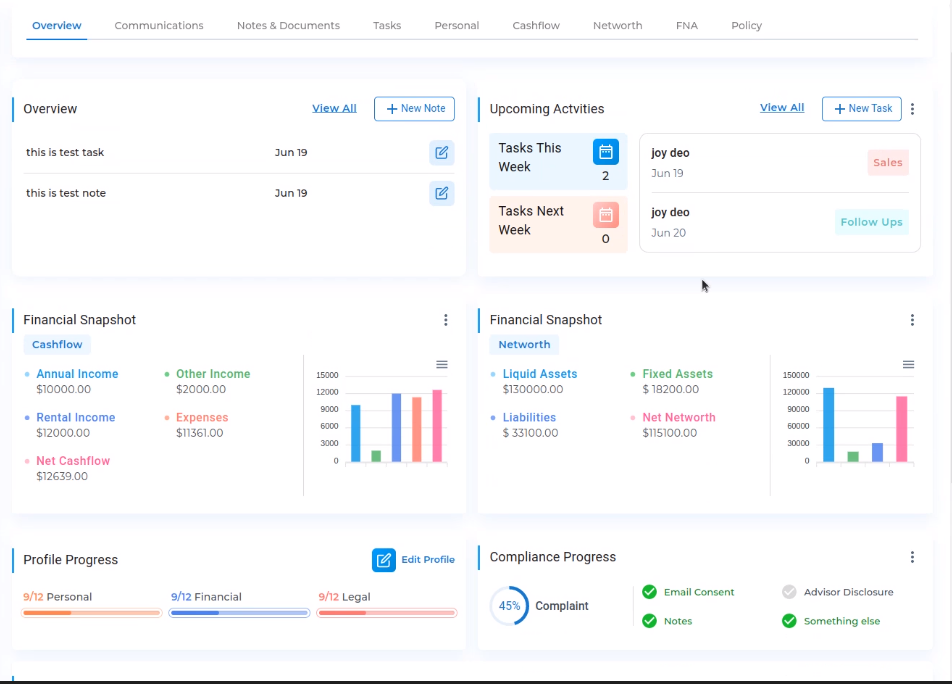

BlueMind elevates the way you do business. It provides one secure place for everything you do. The right documents at the right moments. At your fingertips. With built-in compliance, error-prevention, and email integration.

BlueMind is outreach with no limitations. You’ll keep more people happier because it’s so easy. Correspondence is automated. Birthdays and anniversaries are remembered. Conversations and notes are always handy. You’ll never fail to leave a positive impression.

Because BlueMind is customized for advisors, you don't have to waste time making it work. It starts paying for itself within hours of uploading your data. Then it keeps on paying. The ROI is nothing short of spectacular.

Like a real assistant, BlueMind takes care of time-consuming administrative work. Is 40 hours an overstatement? For most advisors, data entry, correspondence, and document management take at least that much time.

⭐⭐⭐⭐⭐

"For advisors, there’s nothing else like

BlueMind on the market. It offers far more than a CRM

because there’s so much built-in power to manage

and grow your business."

Explore Features

Expedites Sales Process

Automated Correspondence

Automated Greeting Cards

Email Integration

Contact Management

Calendar Integration

Compliance Checklist

Enhanced Security

Task Reminders

Virtual Folders

Voice-to-Text

Client Portal

Client Reporting

Continuing Ed Credit Storage

License and Contracting Storage

User Privilege and Access Control