Why You Need BlueMind?

Are you struggling with manual paperwork & disorganized documents?

Are you overwhelmed with admin tasks in your financial advisory work?

Do you worry about client data security, compliance regulations, safe and easy document sharing?

If the answer is YES, then you have come to the right place.

.jpg?width=1080&height=1080&name=November%20BM%20Social%20Media%20Posts%20%20(3).jpg)

The Struggles of Choosing the Right Software

- Choosing software is tough with many options promising useful features

- Even after reading reviews, you're unsure what you need

- Fear of making a wrong decision stops you from getting the right software

- If you're picking software for your financial firm, you worry about harming your company or career

- You need a smart, low-risk decision to transform work processes

What Type of Solutions are there in Market?

The below 3 are the types of tools that are available for advisors. Without naming any of the brand or company name, we have compared them from pros/cons perspective for a financial advisor like you.

| Pros | Cons |

|

|

| Pros | Cons |

|

|

| Pros | Cons |

|

|

Pros:

- Low-cost and easy to get started

Cons:

- Complex and disorganized workflow, feeling overwhelmed

- The administration is taking too much time

- High cost of capturing, collecting, analyzing, and safeguarding client data

- Anxiety about keeping up with compliance regulations

Pros:

- Help organize your workflows, generate sales and build client relationships

- Have some financial-specific features

Cons:

- You often need to buy a subscription for several financial tools, because they are not an “all-in-one” solution and require add-ons or integrations, which are not always available

- You worry about where your clients’ data is stored

- Some tools are not designed with financial advisors’ needs in mind

- Some tools don’t help much with regulatory compliance

Pros:

- Help organize your workflows, generate sales and build client relationships

- Can be budget-friendly

Cons:

- Not designed for financial advisors: lack financial-specific features, e.g., compliance tools

BlueMind’s Approach: Closing the Gaps in the Market

The reason why we created BlueMind is to close the gap in the market, by introducing an all-in-one CRM, designed by advisors and for advisors, with compliance in mind. BlueMind is as simple, as ABC:

- A for Administration (easing your work processes)

- B for Business Relations (communicating with your clients professionally)

- C for Compliance (complying with constantly evolving regulations imposed on advisors).

-

All-in-One Platform

-

Designed for Advisors

-

Build-in Compliance

-

Cost-Effective

-

No Training Required

-

Advisor Financial Tools

-

Advisor Goal/Revenue Tracking

-

Simple Setup & Onboarding

-

Secured & Shareable Documents

12 Reasons Why BlueMind is the Better

Here are the 12 reasons why BlueMind is better than all other Financial CRMs available in the market

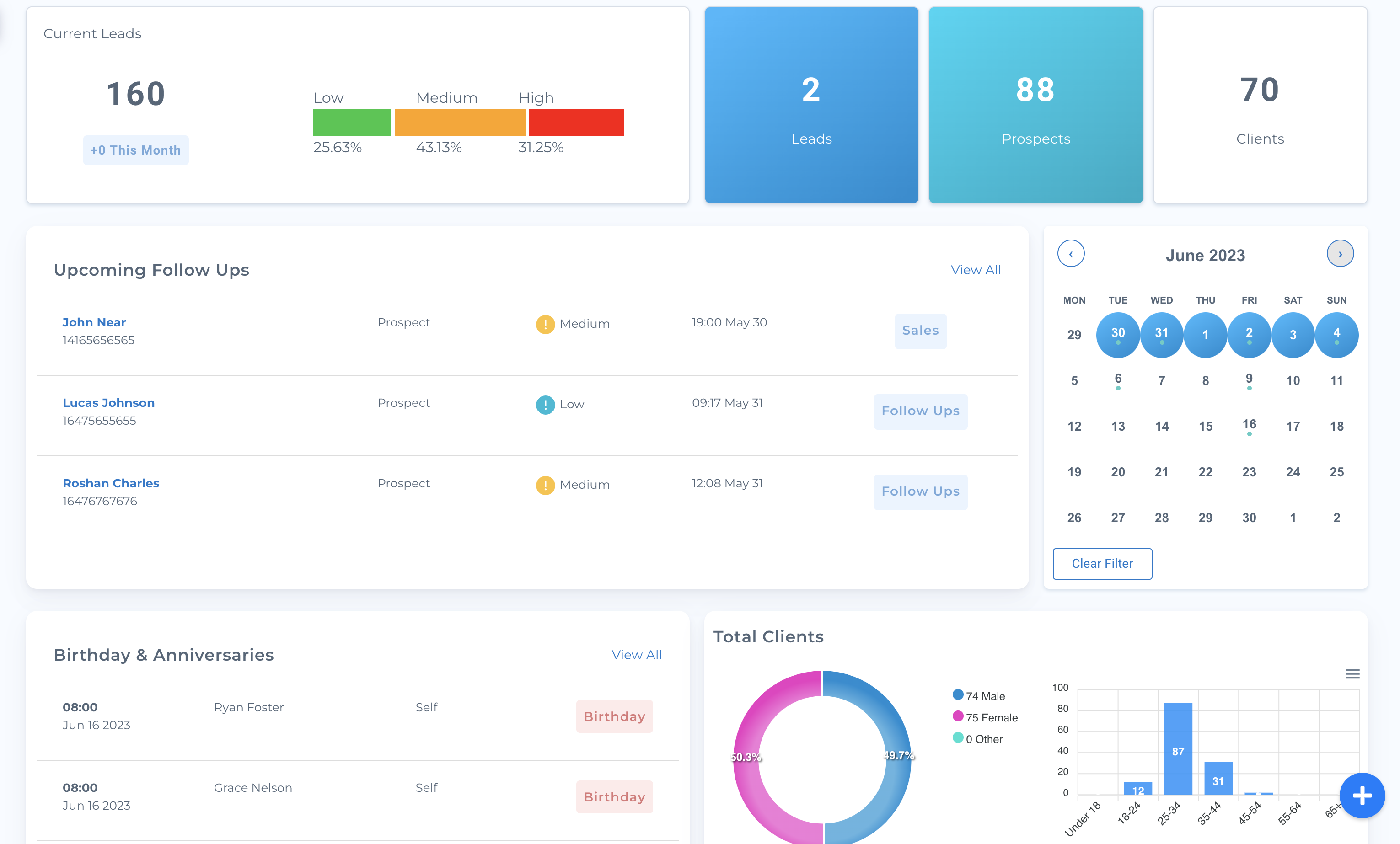

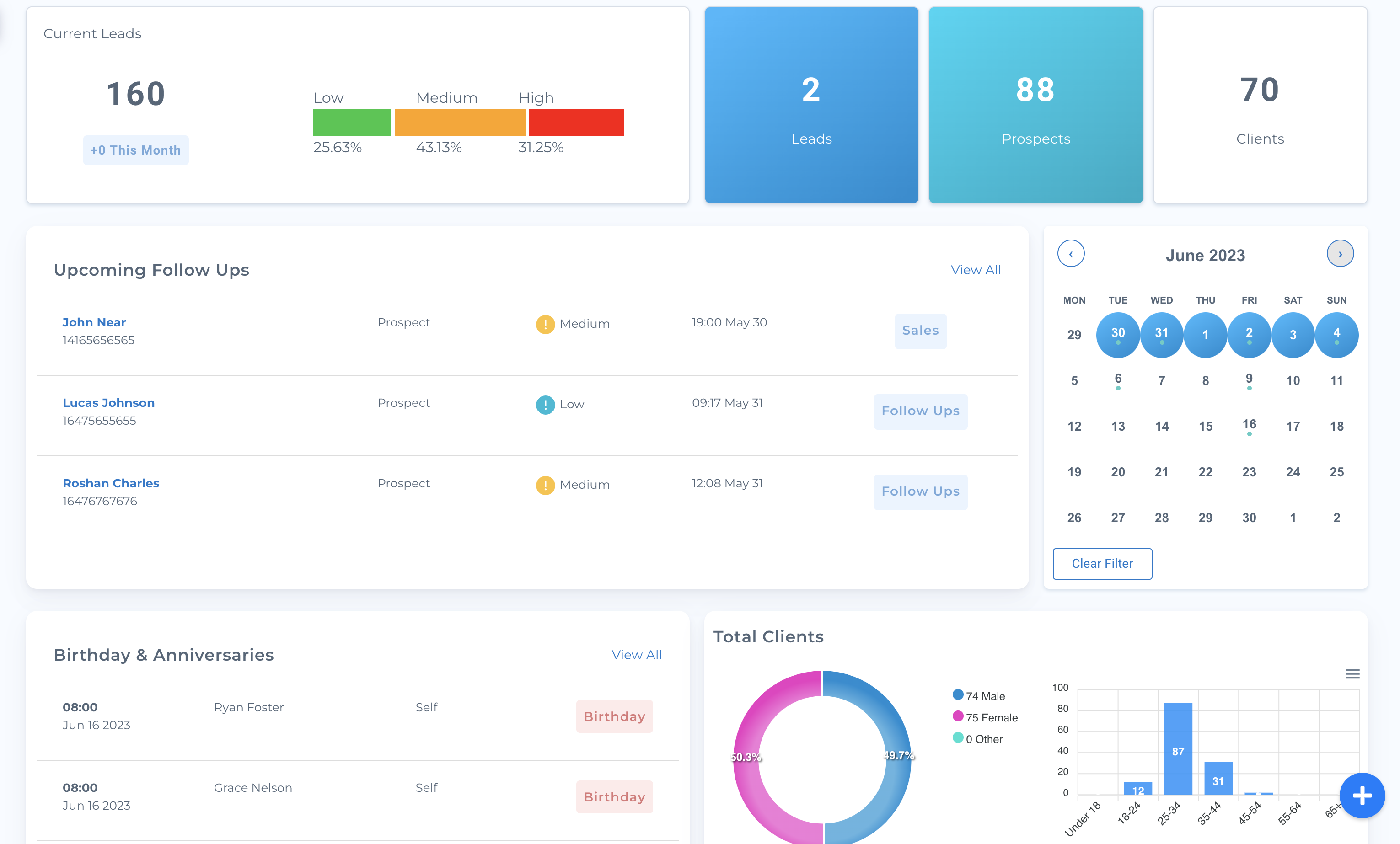

Comprehensive

1. All-in-One Platform, Designed by Advisors for Advisors

BlueMind is a B2B SaaS platform developed by advisors for financial advisors. It is designed to complete day-to-day tasks in less time with more efficiency, thus saving time and increasing revenue. This all-in-one tool streamlines tasks, elevates client relations, and ensures compliance.

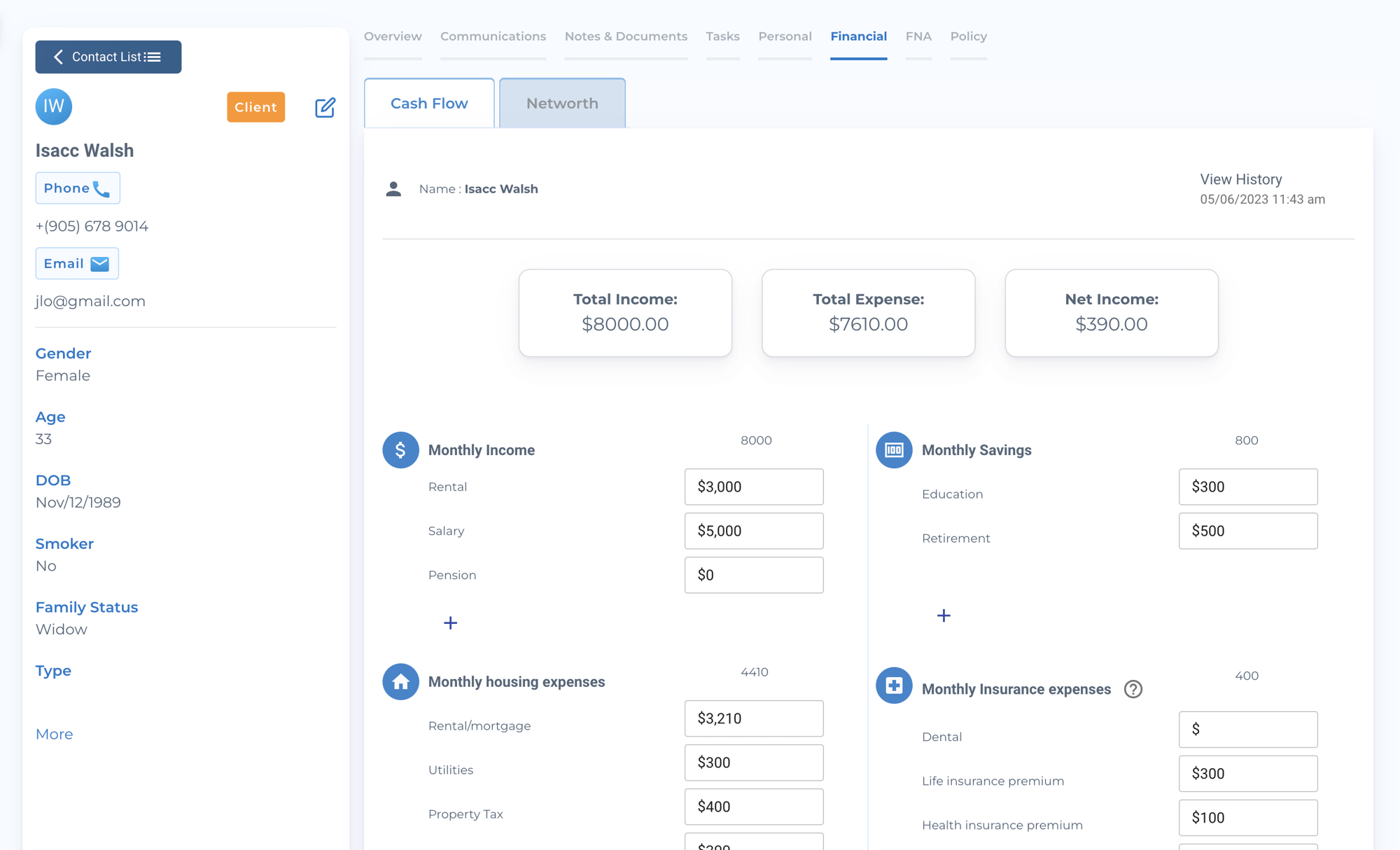

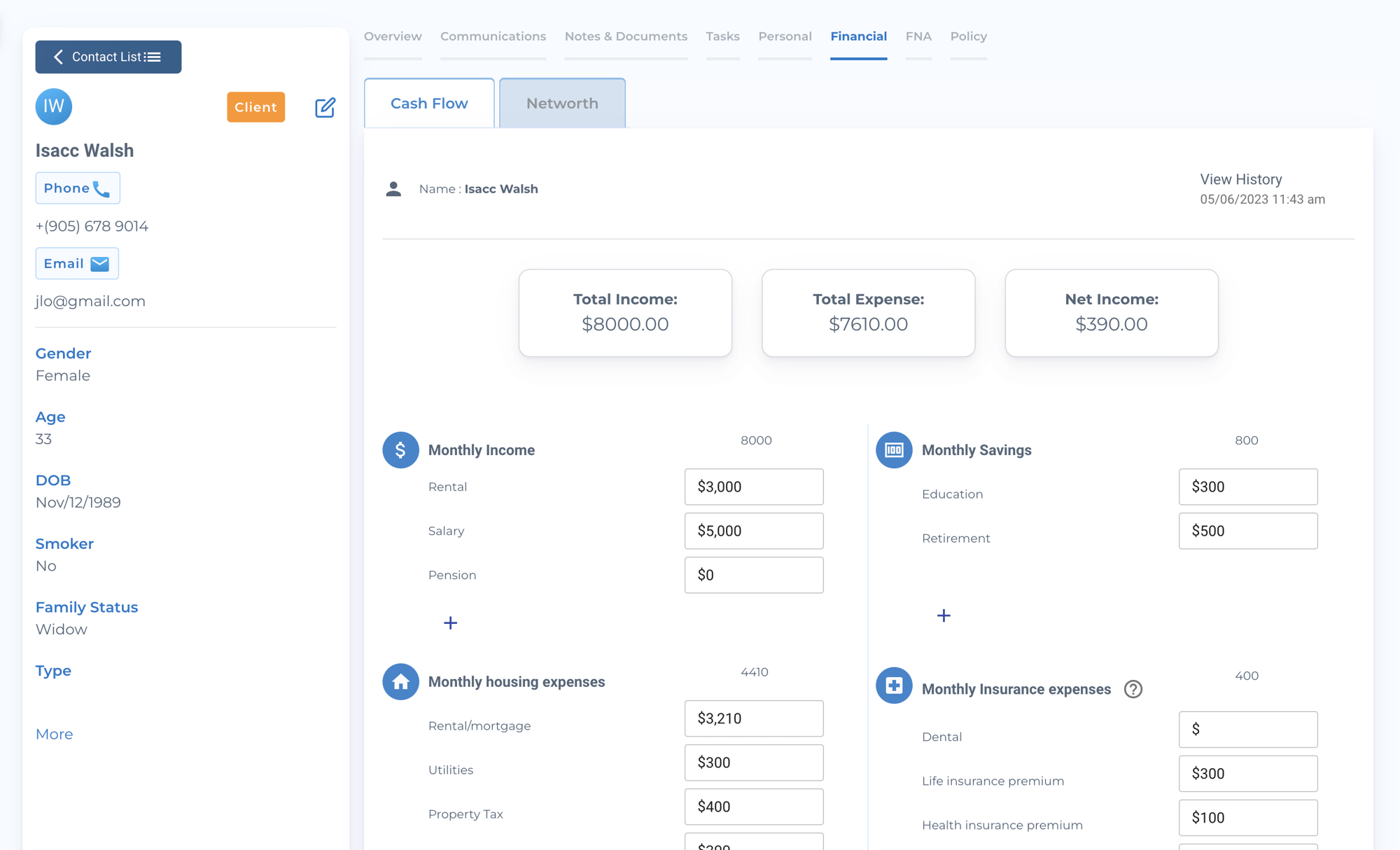

2. Advisor Financial Tools

BlueMind has all the financial tools that advisors need such as FNA (Financial Needs Analysis), Cash Flow Statements, Net-worth Statements etc. You don’t need any other financial tools separately. With BlueMind you can do everything in a single platform securely.

3. Simplified Advisor Analytics & Reporting

BlueMind streamlines data analysis and reporting for financial advisors. It helps you track client portfolios, assess performance, and generate comprehensive reports. With user-friendly features and intuitive interfaces, it simplifies complex financial data, allowing you to make informed decisions.

Comprehensive

1. All-in-One Platform, Designed by Advisors for Advisors

BlueMind, a B2B SaaS platform for financial advisors, boosts efficiency by streamlining tasks, saving time, and increasing revenue. It enhances client relations and ensures compliance, offering a comprehensive solution.

2. Advisor Financial Tools

BlueMind provides essential financial tools like FNA, Cash Flow Statements, and Net-worth Statements, all in one secure platform. You can efficiently perform tasks without the need for separate tools.

3. Simplified Advisor Analytics & Reporting

BlueMind simplifies data analysis & reporting, enabling portfolio tracking, performance assessment, and report generation. Its user-friendly & intuitive interface simplify complex financial data for informed decision-making.

Compliance-Oriented

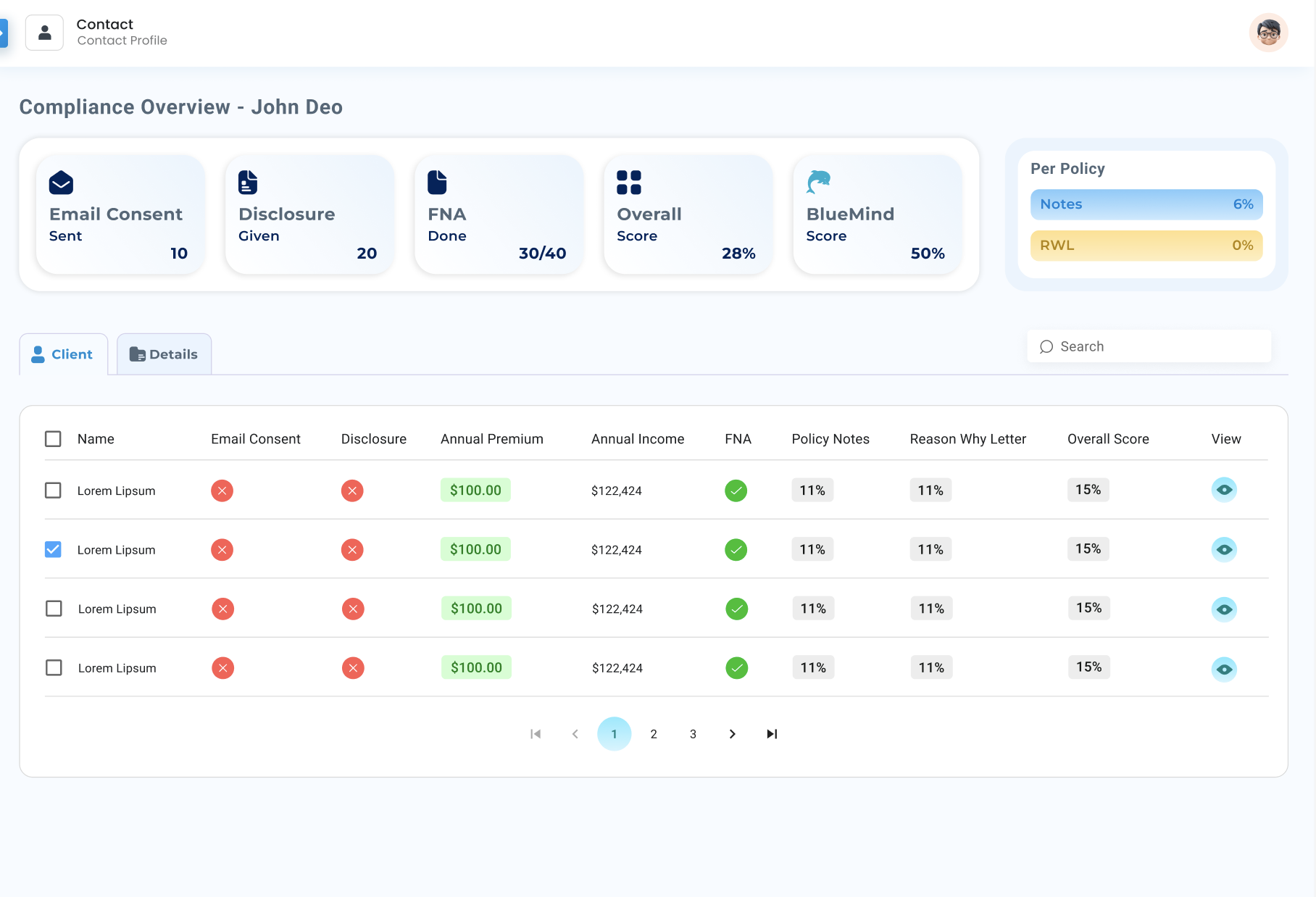

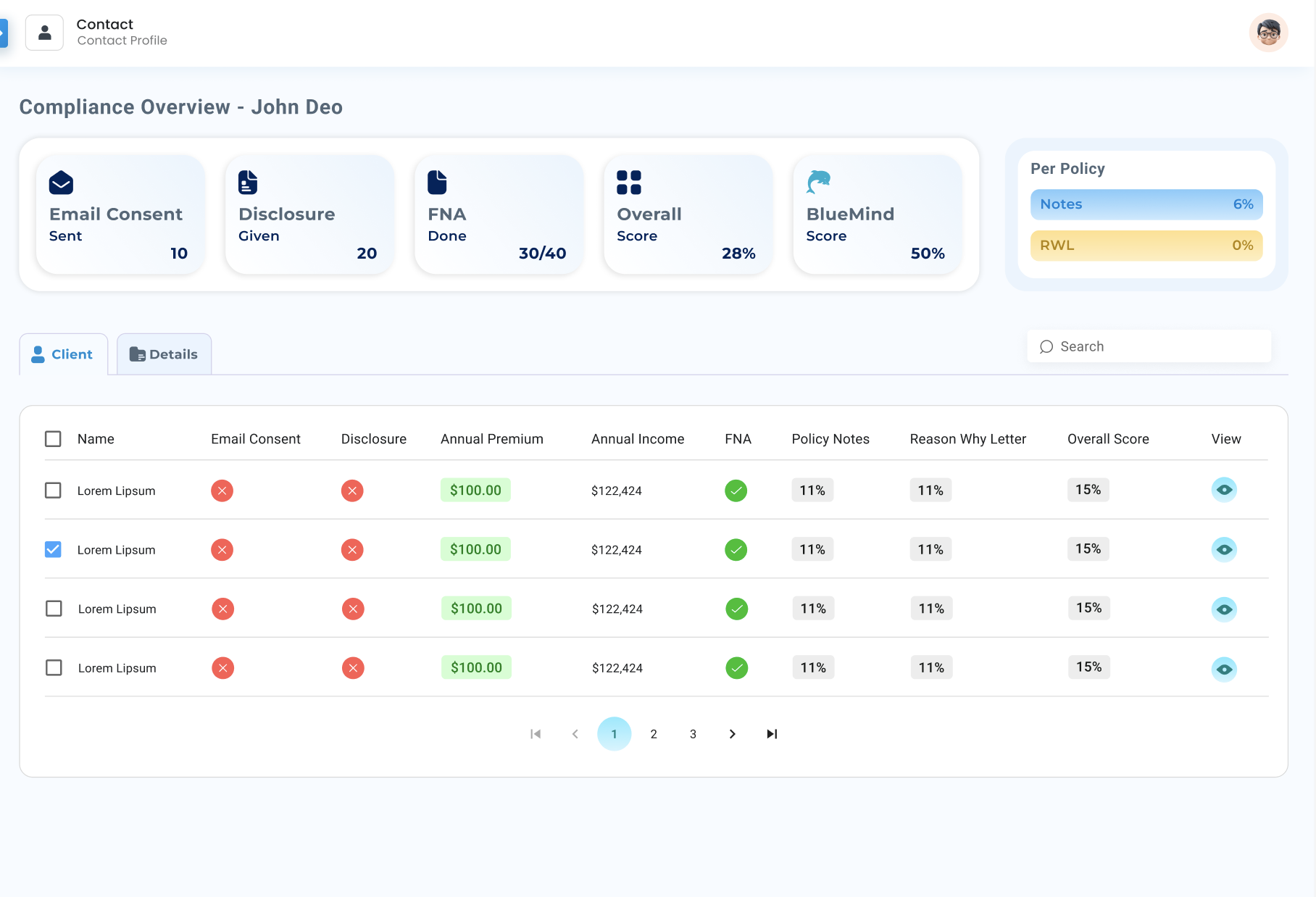

4. Built-in Compliance checklist

Our Built-in Compliance Checklist simplifies regulatory adherence for financial advisors, ensuring focus on core responsibilities. It reduces risks, enhances client trust, and keeps you compliant.

5. Pre-built virtual folders for advisor compliance

Ready-made digital folders meet regulatory requirements, allowing advisors to securely store and access documents. This enhances efficiency, ensures compliance, and reduces administrative burden.

6. Compliance documents with e-signatures

BlueMind enables advisors to securely generate, share, and sign compliance documents electronically, reducing paperwork and ensuring a legally binding digital trail, providing seamless client experience.

Revenue Focused

7. Scales from Individual Advisors to MGAs

BlueMind allows you to effortlessly scale your operations from individual advisor accounts to many or even at MGA level. With intuitive tools and support, the transition is smooth, enabling advisors to maintain efficiency and effectiveness as they evolve into MGAs, catering to a broader client base and driving business growth.

8. Cost-Effective & Budget Friendly

BlueMInd prioritizes affordability without compromising quality. We offer a range of pricing options that fit your budget, ensuring that you get the most value for your investment. With transparent pricing structures and no hidden fees, you can confidently access powerful financial tools without breaking the bank.

9. Advisor Goal & Revenue Tracking

BlueMind empowers financial advisors like you to set, monitor, and achieve their business goals. With real-time data and insights, it streamlines the tracking of revenue goals, helping you stay on track to meet your targets. BlueMind enhances planning, enabling you to optimize your strategies and drive sustainable growth.

Revenue Focused

7. Scales from Individual Advisors to MGAs

BlueMind facilitates seamless scalability from individual advisor accounts to MGA level. Advisors can transition smoothly, maintaining efficiency while expanding their client base and driving business growth.

8. Cost-Effective & Budget Friendly

BlueMind ensures affordability with quality, offering flexible pricing options that fit your budget. Transparent structures and no hidden fees guarantee confidence in accessing powerful financial tools without overspending.

9. Advisor Goal & Revenue Tracking

BlueMind empowers financial advisors to set, monitor, and achieve business goals. Real-time data streamlines revenue goal tracking, aiding in target achievement. It enhances planning for sustainable growth.

Securely Collaborative

10. Secured and Shareable Documents

BlueMind's Secured and Shareable Documents feature enables advisors to securely store and share documents, ensuring confidentiality and collaboration while enhancing efficiency and client service.

11. Smart Notes

BlueMind's Smart Notes feature offers voice-to-text capability, allowing advisors to quickly capture thoughts and ideas. This enhances productivity and efficiency by simplifying note-taking processes.

12. Modern Client 360 View (Client Portal)

BlueMind's Client Portal feature provides clients with secure access to their financial profile. This fosters transparency, strengthens communication, and enhances the overall client-advisor relationship.

See what our Users say about Us

"BlueMind has helped me streamline and automate my business by making it easier to manage my clients, track progress and stay compliant! Mind-blowing!

I highly recommend this to any advisor, whether you are just starting, developing or transitioning out of the business!"

"If you want to leave a mounting stress behind and move toward a more successful and enjoyable career as an Agent in this market, all you need is a proven system that fundamentally different than what you have been doing.

BlueMind is bringing your Business to the next level! "

"Migrating from a big-name CRM to Blue Mind was a well-thought-out decision. We sought more practical solutions to manage the data and service our clients. BM has helped us. Automating specific tasks is one of the best features to be mentioned. BlueMind brings simplicity and sophistication together."

"I've been using BlueMind CRM to manage my insurance clients for almost a year now, and I must say, it has been a game-changer for my business. As an insurance broker, having a reliable and efficient CRM is crucial, and BlueMind has exceeded my expectations. It's a game changer for financial advisors!"

"BlueMind has helped me streamline and automate my business by making it easier to manage my clients, track progress and stay compliant! Mind-blowing! I highly recommend this to any advisor, whether you are just starting, developing or transitioning out of the business!" Dr. Shehnaz HussainCEO/broker at Intuitive Financial Solutions, CLU CHS EPC PHD Natural Medicine

Dr. Shehnaz HussainCEO/broker at Intuitive Financial Solutions, CLU CHS EPC PHD Natural Medicine

"If you want to leave a mounting stress behind and move toward a more successful and enjoyable career as an Agent in this market, all you need is a proven system that fundamentally different than what you have been doing.

BlueMind is bringing your Business to the next level! " Nannette BritanicoPresident of Britanico & Associates Financial Services, CLU, CHS, MDRT

Nannette BritanicoPresident of Britanico & Associates Financial Services, CLU, CHS, MDRT

"Migrating from a big-name CRM to Blue Mind was a well-thought-out decision. We sought more practical solutions to manage the data and service our clients. BM has helped us. Automating specific tasks is one of the best features to be mentioned. BlueMind brings simplicity and sophistication together." Vikram JanjuaPresident of Trupax Financial Limited, Insurance Broker

Vikram JanjuaPresident of Trupax Financial Limited, Insurance Broker

"I've been using BlueMind CRM to manage my insurance clients for almost a year now, and I must say, it has been a game-changer for my business. As an insurance broker, having a reliable and efficient CRM is crucial, and BlueMind has exceeded my expectations. It's a game changer for financial advisors!" Suzette ChambersFounder of Sue Chambers Financial Services, Insurance Broker, Motivational Speaker

Suzette ChambersFounder of Sue Chambers Financial Services, Insurance Broker, Motivational Speaker

Get Started Today!

Avoid Compliance Risk, Improve Client Management & Expand your Business!